Enhancing Stock Market Predictability: A Comparative Analysis of RNN And LSTM Models for Retail Investors

DOI:

https://doi.org/10.54060/jmss.v3i1.42Keywords:

stocks, Prediction, RNN, LSTM, retail investor, deep learning algorithms, Stock Price Prediction, stock marketsAbstract

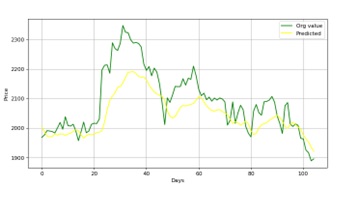

The stock markets are important components of the global financial system and have a considerable impact on an economy's growth and stability. This research article uses algorithms, notably deep learning, to increase the prediction of stock values. The efficacy and precision of long short-term memory (LSTM) and recurrent neural networks (RNN) algorithms to estimate stock prices are compared in this study. The paper investigates the potential of deep learning algorithms in creating a more predictable and trustworthy environment for the stock market. The study utilizes historical market data obtained from the Alpha Vault API and evaluates the performance of the RNN and LSTM models in forecasting stock prices. The results indicate that LSTM exhibits superior precision and is better suited for stock price prediction, while RNN faces certain challenges. Overall, this research contributes to the understanding of the application of deep learning algorithms in stock market analysis, to make informed investment decisions, thereby reducing risks and maximizing returns.

Downloads

References

R. Karim, Stock Market Analysis Using Linear Regression and Decision Tree Regression”. 2021.

L. Bokonda and N. Ouazzani Touhami Khadija, Predictive analysis using machine learning: Review of trends and methods”. 0.1109/ISAECT50560.2020.9523703.

S. Cankurt and A. Subasi, Comparison of linear regression and neural network models forecasting tourist arrivals to Turkey”, IJEAT. 2019.

H. Alaskar and H. Alaskar, Machine Learning and Deep Learning: A Comparative Review”. 2021. 10.1007/978-981-33-6307-6_15

K. Sethi, A. Gupta, G. Jaiswal and et. al, Comparative Analysis of Machine Learning Algorithms on Di_erent Datasets, 2019.

S. Ray, “A quick review of machine learning algorithms,” in 2019 International Conference on Machine Learning, Big Data, Cloud and Parallel Computing (COMITCon), 2019.

J. Orozco, Luis, M. Manzanera, et. al, “The machine learning horizon in cardiac hybrid imaging VL-2”,” European Journal of Hybrid Imaging, 2018. 10.1186/s41824-018-0033-3

E. Charniak, Introduction to deep learning. London, England: MIT Press, 2019.

S. Pouyanfar et al., “A survey on deep learning: Algorithms, techniques, and applications,” ACM Computing Surveys (CSUR), vol. 51, no. 5, pp. 1–36, 2018

Z. C. Lipton, “A Critical Review of Recurrent Neural Networks for Sequence Learning”, Carnegie Mellon University, 2015

S. Selvin, R. Vinayakumar, E. A. Gopalkrishnan, et. al, "Stock price prediction using LSTM, RNN and CNN-sliding window model," in International Conference on Advances in Computing, Communications and Informatics, 2017

T. Kim and H. Y. Kim, "Forecasting stock prices with a feature fusion LSTM-CNN model using different representations of the same data," PloS one, vol. 14, no. 2, p. e0212320, 2019.

H. Sadia, A. Sharma, A. Paul, and et. al., “Stock Market Prediction Using Machine Learning Algorithms,” IJEAT, 2019.

F. Gers, “Long short-term memory in recurrent neural networks.” Lausanne, EPFL, 2005.

S. Hochreiter, “The Vanishing Gradient Problem During Learning Recurrent Neural Nets and Problem Solutions”, Sepp Hochreiter Johannes Kepler University Linz.

Z. Fan and Y. Wang, “Stock price prediction based on deep reinforcement learning,” in Lecture Notes in Electrical Engineering, Singapore: Springer Nature Singapore, 2022, pp. 845–852.

F. A. Khan and M. Mohiuddin, “A comprehensive review of machine learning algorithms for stock market prediction. Intelligent Systems in Accounting,” Finance and Management, vol. 29, no. 1, pp. 35–59, 2022.

S. Aggarwal and V. Kumar, “Stock market prediction using hybrid models: A comprehensive review,” Journal of Ambient Intelligence and Humanized Computing, vol. 13, no. 3, pp. 3905–3929, 2022.

S. Zhang, Y. Jiang, and X. Yan, “Stock Market Prediction Based on Deep Learning: A Survey,” IEEE Access, vol. 9, pp. 55239–55256, 2021.

Downloads

Published

How to Cite

CITATION COUNT

Issue

Section

License

Copyright (c) 2023 Nevendra Kr Upadhyay, Vineet Singh, Dr. Shikha Singh, Dr. Pooja Khanna

This work is licensed under a Creative Commons Attribution 4.0 International License.